are funeral expenses tax deductible in 2020

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. In short these expenses are not eligible to be claimed on a 1040 tax.

Common Health Medical Tax Deductions For Seniors In 2022

This means that you cannot deduct the cost of a funeral from your individual tax returns.

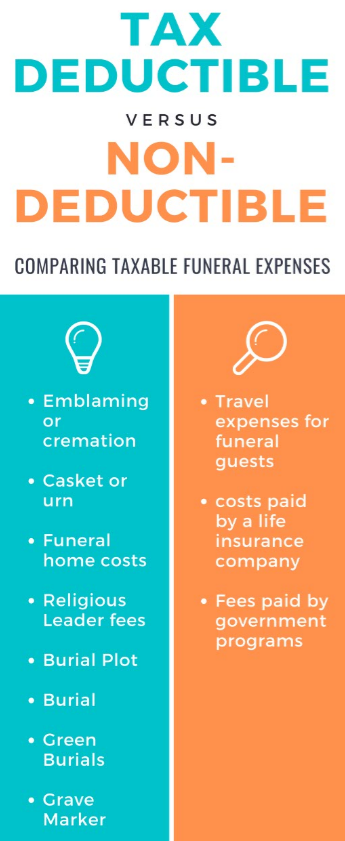

. Some funeral homes can actually make matters worse by recommending unnecessary funeral expenses or services that drive up the average funeral cost beyond what. If the IRS requires. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the.

The bankruptcy estate is allowed a deduction for any administrative expense allowed under section 503 of title 11 of the US. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return. IRS rules dictate that all estates worth. Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax return said Catherine Romania an estate planning attorney with.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. In short these expenses are not eligible to be claimed on a 1040 tax. Code and any fee or charge assessed.

No never can funeral expenses be claimed on taxes as a deduction. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The IRS allows deductions for medical. Individuals cannot deduct funeral expenses on their income tax returns.

Funeral Costs Paid by the Estate Are Tax Deductible. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the. The 300 of expenses incurred.

A death benefit is income of either the estate or the beneficiary who receives it. Funeral expenses are not tax deductible because they are not qualified. Individuals cannot deduct funeral expenses on their income tax returns.

In short these expenses are not eligible to be claimed on a 1040 tax form. While the IRS allows deductions for medical expenses funeral costs are not included. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit.

While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes. Individual taxpayers cannot deduct funeral expenses on their tax return. You may not deduct funeral expenses on your individual tax returns but there is a way you can save on funeral costs in todays economy.

These expenses may include. The IRS deducts qualified medical expenses. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

Common Health Medical Tax Deductions For Seniors In 2022

Are Funeral Expenses Tax Deductible It Depends

What Can You Deduct At Tax Time 2020 Update Smartasset

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Charitable Gifts And Donations Tracker Template Excel Templates Charitable Gifts Donation Letter Donation Form

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Are Funeral Expenses Tax Deductible It Depends

The Simple Path To Wealth By Jl Collins Summary And Key Takeaways Youtube Wealth Collins Simple

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Account Tracker Project Planner Project Planner Printable Printable Planner

Retirement Budget Worksheet Budgeting Worksheets Retirement Budget Budget Spreadsheet Template

A Blog To Elevate Your Own Life Dreams Freedom Happiness Fund Recruitment Retirement Fund

Are Funeral Expenses Tax Deductible Funeralocity

11 Types Of Tax Incentives How They Differ In Their Functionality Income Tax Income Tax Return Tax Refund

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

Cpp Payment Dates 2021 How Much Cpp Will You Get Payment Date Pension Benefits Retirement Income